-

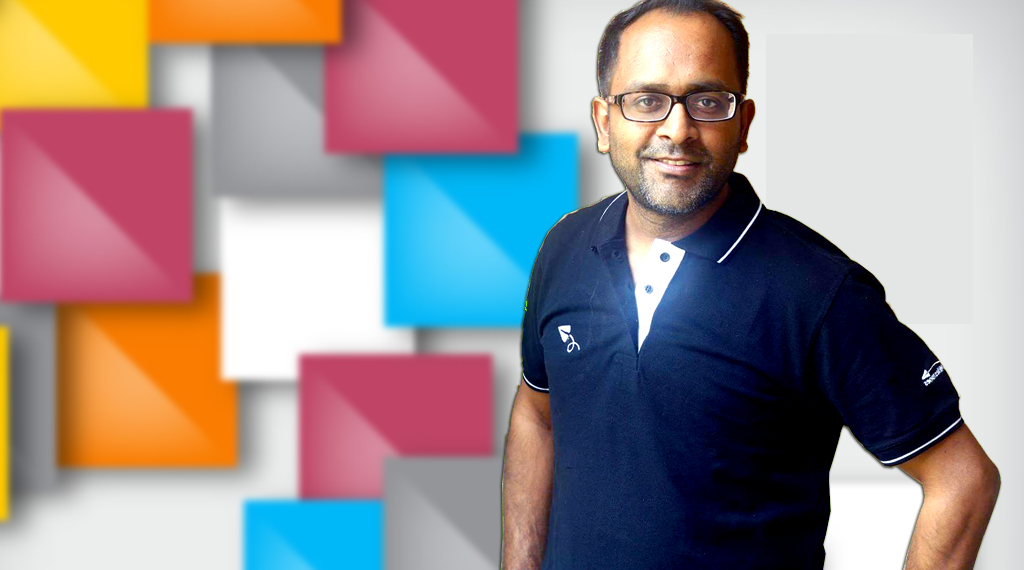

- Today we have Toshaj Oza a qualified Chartered Accountant sharing with us – The List of Forensic Accounting Certifications in India especially CFE.

- He is a Chartered Accountant, Certified Fraud Examiner (CFE), has done his Diploma in Systems Audit (DISA | ICAI) and has done the certificate course in Forensic Accounting and Fraud Prevention (FAFP | ICAI).

Journey Becoming a Chartered Accountant

Regarding my Chartered Accountancy journey, it has been a very intriguing one.

I am a qualified Chartered Accountant from ICAI (The Institute of Chartered Accountants of India).

I cleared my CPT (1st level CA exam from ICAI) on my 1st attempt, my IPCC (2nd level CA Exam) on my 3rd attempt, and my CA Final exam again on my 1st attempt.

So that means you can fail multiple times in IPCC and still clear CA Final on your 1st attempt!

I had enrolled for CA Final classes but articles (internship) almost never allowed me to attend them, so you could say I cleared CA Final purely by self-study.

I did my internship in Tax/Audit at J.T Shah & Co, a mid-sized CA firm in Ahmedabad, India.

My articles experience mainly consisted of traditional Audit and Tax work (nothing related to Forensic Accounting).

After qualifying as a Chartered Accountant I realized traditional Audit and tax is not for me.

I wanted to specialize in a field but I did not know which field. I researched the available alternatives and Forensic Accounting just seemed perfect for me.

The hardest part, I got offers from Big 4 international accounting firms like EY, Deloitte, etc after qualifying as a CA. However, they all offered me opportunities in Audit and not Forensic Accounting! Thus I had to reject the same.

In short, I got no offers for Forensic Accounting profiles, the reason was – No experience in Forensic Accounting during my internship.

Luckily I got an offer from a mid-sized firm in India that was into Forensic Accounting services and started my career.

After working in a mid-sized firm for almost 2 years, I moved to Big 4 Firms like PwC and Deloitte in their Forensic Investigation Team.

What is Forensic Accounting?

- Forensic Accounting is basically a mix of Accounting Practice, investigation, and auditing. Hence Financial Detectives like me mostly (not always!) start out as traditional Public Accountants/ Chartered Accountants and then they move on to more specialized departments in Forensic Accounting.

- Although Forensic Accounting is not only limited to services related to accounting but involves many other services such as due diligence, market intelligence, dispute services, conducting suspect interviews, data analysis, etc.

- For Forensic Accounting there are many other courses available from other institutes but according to me Certified Forensic Examiner (CFE), ACFE is the best.

- I would always recommend some other credentials which would complement the CFE such as – Certified Internal Auditor, Certified Information System Auditor, etc.

- If one wants to study further in Forensic Accounting then one must pursue Ph. D. on a specific topic in Forensic Accounting.

List of Certifications to Become a Forensic Accountant

When I qualified as a Chartered Accountant from ICAI, I researched and found the following available courses related to Forensic Accounting:

- Forensic Accounting and Fraud Examiner – IFS EDUCATION DEPARTMENT

- Forensic Accounting and Fraud Prevention as offered by The Institute of Chartered Accountants of India (ICAI)

- CFE by the Association of Certified Fraud Examiners – ACFE

- Institute of Certified Forensic Accountants

- http://indiaforensic.com

- Gujarat Forensic Sciences University

CA ANZ has recently (2018) introduced the Forensic Accounting specialization module in its CA qualification. If a qualified Chartered Accountant has a similar experience, they can enroll in this module. For details please visit the links Specialisations Forensic Accounting and Member services Forensic.

There are many Forensic Accounting Degree Courses also available from International Colleges.

- Similarly Chartered Accountant and CPA Institutes from different countries have their own certifications for members.

Based on my research I decided to pursue the course offered by:

- Association of Certified Fraud Examiners (ACFE)– That is a CFE course.

- I also completed the certificate course on Forensic Accounting and Fraud Prevention (FAFP) as offered by The Institute of Chartered Accountants of India (ICAI).

Forensic Accounting and Fraud Prevention as offered by ICAI

- The certificate is just like a trailer (simple and sweet!). It will just show a glimpse of the field i.e Forensic Accounting & Fraud Detection.

- Although, it is also very useful to meet fellow members who are already practicing in that field or looking for opportunities in that field. It is better for making good connections.

- You would also get a better understanding of how are opportunities by discussing with the lecturers.

- Moreover, your chances of being impaneled in any forensic accounting-related work increase. In fact, I got my first job opportunity in a Forensic Accounting Firm while attending this Certification Course by The ICAI!

- All in all, I would say that it is a good option if you’re looking to start a career as a Forensic Accountant. However, as a professional certification, it is certainly not enough. If you want to be recognized as a serious forensics specialist and a fraud auditor, I would personally recommend doing CFE (Certified Fraud Examiner).

Certified Fraud Examiner (CFE) from ACFE

- CFE Credential is the most recognized credential showing expertise in the field of Forensic Accounting and Fraud Prevention.

- Their Fraud Examiner’s Manual is the ultimate source guide for any professional working in the field of Forensic Auditing.

- Every year they publish a Report to the Nations on Occupational Fraud and Abuse which gives a summary & statistics of all fraud investigations conducted by CFEs all around the globe. The same is available to the public for study.

- The Association of Certified Fraud Examiners is the world’s largest body of Fraud Fighting Professionals.

- The Certified Fraud Examiner (CFE) credential is accepted worldwide as the standard of excellence in the anti-fraud profession.

- The credential of CFE is also recognized in the hiring and promotion policies of leading organizations, including the FBI, the U.S. Department of Defence, and the U.S. Securities and Exchange Commission (SEC).

- In the uncovering of the world’s largest fraud, CFE was the primary responsibility for the same (Enron Case).

Editions of CFE:

There are 2 editions available for the course – The US Edition and the International Edition.

I have done the CFE International Edition – The only reason they have a separate course material is that of the Law section.

If someone does the International Edition and moves to the US then there is no need to do the US one again, though employers in the US would prefer the US one.

The 2 editions are as follows:

- The US Edition: In the US Edition all the laws covered would be in relevant to the US.

- The International edition: In the International Edition they have covered what is majorly applicable all over the globe. All other sections are similar.

How to become a Certified Fraud Examiner from ACFE

There are basically 2 types of memberships offered by ACFE:

Associate Membership: Becoming an Associate member is the first step on the path to becoming a Certified Fraud Examiner (CFE); only ACFE members can become CFEs. Associate Membership is open to individuals of all job functions, industries, and levels of experience who are interested in the prevention, detection, and deterrence of fraud. To become an associate member one has to just register on their website by paying the required fees for becoming an associate member

Certified Fraud Examiner: To qualify for Certified Fraud Examiner you must first be an associate member having 2 years of fraud-related professional experience and have a minimum Bachelor’s degree and good standing. All the details would be on the website

They have a point system to see the eligibility of the candidate. Once you fulfill the minimum points requirement you would be eligible to apply for the examinations. Details are here.

How to prepare for the CFE Exam

- Study with the exam Prep Course: CFE Exam Prep Course is a computer self-study course available in the U.S. and International editions.

- Attend the CFE Exam Review Course: This 4-day, instructor-led course provides the essentials needed to pass the CFE Exam and become a Certified Fraud Examiner (India is not covered).

- Study on your own using the Fraud Examiners Manual:

- The Fraud Examiners Manual is a 2,000-page guide exploring examination techniques and procedures.

- The study of Fraud Examiners Manual is the ultimate guidebook for Fraud Examiners.

- The Fraud Examiners Manual contains – The complete procedures to be performed for interviewing during investigative assignments along with all the precautions.

- It gives a complete guide as to what should be included in a Fraud Examination Report and how is it to be prepared.

- It has detailed guidance on Data Analytics, Documentation Examination & Preservation, Textual Analytics, etc.

- Further, it has given a pre-defined checklist that could be used for the purpose of performing Fraud Risk Assessments.

- We can say that when it provides an end-to-end solution on how to conduct any kind of Forensic Accounting assignment.

A little more about CFE study material:

- ACFE themselves provide the Study Material which is called a CFE Exam Prep Course along with a soft copy of the Fraud Examiner’s Manual.

- As mentioned above they also have a CFE Exam Review Course conducted at various locations though India is not covered.

- Also, if one chooses they can study only the Fraud Examiners Manual and give the exam.

- The cost of the study material depends upon the choice made by the candidate – Prep Course, Fraud Examiners Manual, or CFE Exam Review Course.

- I studied through the: Prep Course offered by them + went through the Fraud Examiners Manual provided with it.

- The total approximate cost of examinations with Prep Course + Exam Feescomes to about INR 80,000 ($1250 approx)

How To Apply for the CFE Exam

- Once you are done with the studies you have to apply for the exam and provide certificates as requested by them on their portal.

- Once our documentation is verified and approved we have to request the exam activation key.

- Once the exam is activated using that key, all 4 sections have to be completed within 30 days of activation

The exam consists of 4 sections:

- Each section consists of 100 questions with passing criteria of 75% for each section.

- Financial Transactions & Fraud Schemes

- Law

- Investigation

- Fraud Prevention & Deterrence.

How to appear CFE exam

- The exam has to be given online/offline on your PC/Laptop.

- The Exam has a number of controls to ensure the integrity of each exam is generated from a master database. No two exams are exactly the same.

- After completing the examination, it has to be submitted for verification from the software itself.

- As per ACFE policy, they do not release passing scores, and only if one has failed then his scores would be revealed hence we cannot determine the passing %.

- Once the exam is submitted they give you the result within 3-5 days and after that, your documentation would go for final verification with the ACFE Board of regents. Within 7 days you would receive the confirmation of CFE Credential and if any additional information is needed they would contact you.

- All four sections have to be cleared and if you fail to clear any one of the sections, the fee for appearing for each failed section is 25USD. The failed section can be tried a maximum of 3 times.

- Additionally, a member of ACFE gets to take part in their community where different people share their knowledge and discuss their problems.

- Also once you are a CFE – They have a minimum CPE Hours requirement annually which has to be fulfilled which helps in staying updated about the latest developments.

- Along with the Prep Courses discussed in the earlier mail, they have a money-back pass guarantee scheme, to qualify for the same, the details are available on their website.

Scope of CFE in India

- I can say that CFE is being given it is due importance because nowadays when you fill up a tender for providing Forensic Accounting services there is always a special clause stating the number of CFE associated with the organization so yes the scope for CFE is increasing in India.

- RBI Red Flagged Accounts need forensics, in the coming period RBI may make it compulsory for advances above a certain threshold.

- Serious Fraud Investigation Office established under the Companies Act, 2013 could also provide investigation assignments for Forensic Accountants.

- Now for transactions review under IBC, Insolvency Professionals appoint Forensic Auditors

- Economic Offences Wings also require the help of Certified Fraud Examiners.

- There are many internal frauds happening in Corporates that will require CFE to be appointed.

- Big MNC has a special Forensic Department in which CFE can be appointed.

- Forensic services are also required during the course of Due Diligence cases of Mergers & Acquisitions.

- Cyber Forensics is one of the growing fields.

Please note the above are facts stated from my experience. It may/may not work for everyone so please do your own research before going ahead.